Banktivity 7.3.2 Banktivity shows you the big picture of your finances by grouping and analyzing all of your accounts in one place. Banktivity makes it easy to add checking, savings, credit cards, investment and other accounts. Whether you enter transactions by hand or use the built in bank connectivity options, Banktivity will start. Banktivity 7 4 2 4 Subtitles 3 2 8 Wimoweh 1 1 68 Cent Shred 1 2 64 Aftershot Pro 2 2 0 – Flexible Photo Workflow Solution Contacts Journal Crm 2 1 12 Things 3 1 – Elegant Personal Task Management Metro Last Light Redux Dlc Tap Forms Organizer 5 Database 5 2 8 Meta – Music Tag Editor 1 9 5. Banktivity 7.3.2 macOS 26 mb. Banktivity (was iBank) is a new standard for Mac money management. With its intuitive user interface and a full set of money-management features, Banktivity is the most complete software available for Mac personal finance.

Banktivity 7.5.3

Banktivity 7 ushers in a new level personal finance management software for macOS. Whether you're taking your first steps in getting your financial house in order, or you're a seasoned veteran of financial software, Banktivity 6 helps you take complete control of your money.

World-class technical support via live chat and email with US-based representatives.

GET ORGANIZED

The first step in money management is to get all your finances in one place. If you’ve used software like Quicken (for Mac or PC), Banktivity's set-up assistant will import your old data. Next — or if you’re just starting out — download current transactions from your accounts online, at no cost, via direct connection to your bank or by using Banktivity's built-in browser to view your accounts and download your data for free.

Banktivity's optional Direct Access* service makes this even easier by connecting to over 10,000 banks worldwide, automatically delivering the latest transaction data to your Mac.

SEE WHERE THE MONEY GOES

Banktivity has the tools you need to set up checking accounts, savings, credit cards, mortgages, investments and more. Then track each and every transaction: fine-tune them by categorizing, tagging, splitting or making custom edits — or let transaction templates do the work for you. Attach receipts or any file to transactions; reconcile to paper statements; search; track payments or transfers in any currency; and manage repeating events with scheduled transactions.

Banktivity 6 also lets you pay bills online! Set up payees, send checks, track their progress and see them appear in your register. You can print checks, too.

Update your accounts at once with Banktivity's Update Everything button, syncing devices and fetching Direct Access data and securities prices.

BUILD SAVINGS

Banktivity's budgeting tools help you to set saving and spending goals, track expenses, cut debt and build a more secure future. By giving your available cash specific purposes, envelope budgeting lets you assign money to different categories and carry over savings.

Banktivity automatically budgets scheduled transactions like paychecks and bills, so by categorizing each expense and editing the budget itself, you can see where your money goes — and how to make it go further! Banktivity does this visually so that you can see your daily progress; compare past, current or projected budgets; and view it all in a Budget vs. Actual report.

SECURE YOUR FUTURE

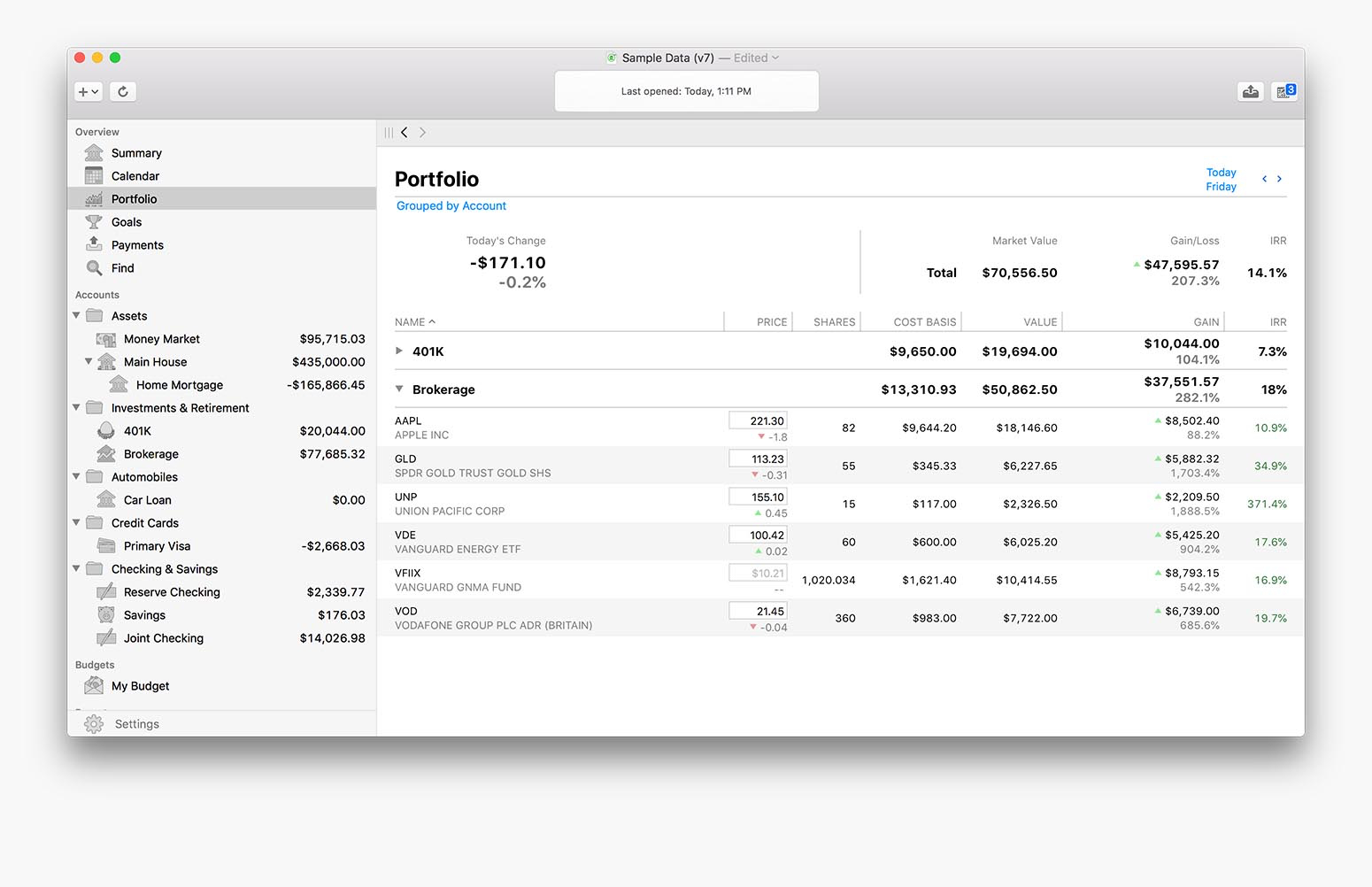

Banktivity's investment features manage stocks, bonds, mutual funds, IRAs, 401Ks, CDs and other assets. You can track buys, sells, splits, dividends, options, etc.; categorize investment transactions; retrieve quotes from Yahoo! Finance or foreign exchanges; analyze ROI and more.

Built-in report templates (Income & Expense, Net Worth, Payee Summary and more) dynamically analyze your finances. Assign tax codes to transactions to generate a Tax Summary report (or export data to TurboTax); or view your holdings in the Portfolio or Investment Summary reports.

Banktivity's reports instantly generate graphs and charts. You can drill down for detail with a click, export table data to spreadsheets, and print reports or save them as PDFs.

WE’RE THERE FOR YOU

No matter where you are, you can enter transactions on the go with Banktivity for iPhone, or sync accounts, budgets and investments to Banktivity for iPad for mobile money management (apps sold separately).

What's New:

Version 7.0:Dark Mode for Mojave:

- Apple has set up a pretty predictable launch schedule with its new versions of macOS and iOS. It goes like this: in June at the World Wide Developers Conference Apple gives us a preview of the new features that are coming. Then we have about three months to adopt any of the new features in the operating systems and make sure our apps don’t just break with the new versions.

- When we saw Dark Mode in Mojave, we knew we wanted to support it. Dark Mode is great for so many different uses on your Mac and for many people here at IGG it has become their preferred work environment.

- We like to support the most recent macOS versions as soon as we are able and I’m thrilled that this year we don’t just support it, but can wholeheartedly embrace it with Dark Mode. This wasn’t a small undertaking, we put a lot of resources into looking at every screen and restructuring how we bundle our visual assets in the app. The rewards for this hard work have been great. Check out how nice Banktivity 7 looks in Dark Mode on Mojave

- It is true that you’ve always been able to track the value of your home or other real estate properties in Banktivity, but it has never been a great solution. In the past, you had to add an asset account and manually adjust the value of your home asset to what you think it might be. This approach has always left a lot to be desired. Wouldn’t it be nice to have the value of your home automatically calculated? And wouldn’t it be nice if you could easily see how much equity you have in your home after you factor in any mortgages or lines of credit? Well, now you can in Banktivity 7.

- For Banktivity 7 we’ve integrated Zillow’s estimating capabilities right into Banktivity. We’ve also designed an entirely new real estate view when you are looking at a home in Banktivity 7. Further, you can now link your real estate accounts with the loans associated with them and see a more complete picture of your properties all in one place.

- For the real estate view, there is no reconcile or search as they never really made sense for assets like a home. Instead, you get a simplified register view to show your 'transactions.' On the right we show you the value of your home as recorded in Banktivity and the value of your home according to Zillow. You can click 'Record It' to enter a transaction that will bring up the value of your home to match Zillow. Two things to note: 1) pulling of prices for Zillow is tied to your Direct Access subscription and 2) Zillow currently only supports homes in the United States. So if you aren’t a Direct Access subscriber and you have one or more properties in the United States, it might be time to reconsider

- For many years our customers have been requesting a calendar view in Banktivity. They want a place to see their past and upcoming transactions as it relates to a calendar. I’m happy to announce that Banktivity finally has a calendar view!

- Our new calendar view shows your posted transactions and upcoming scheduled transactions. It also calculates a running composite balance and a summary of how your investments have performed each week. The calendar is interactive too. You can click on transactions to see them in their account. For unposted scheduled transactions, you can click them and then take action on them by either posting them, skipping them, printing a check or paying online. You can also configure the calendar to only include the accounts you are interested in.

- Stock lot selection. When you sell securities you can choose which lots to sell from, or use the FIFO default

- Search Everywhere. Now you can search your payees, categories, accounts, securities and tags.

- Improved Reconciling. We made some great improvements to reconciling. You can choose to have Banktivity auto-reconcile all transactions, no transactions or just the cleared transactions. We also added search to the reconcile sheet and it remembers the last size you left it at. Last but not least, we made the button to create a statement more obvious!

- Customize the Summary View. You can now choose which accounts you want to be reflected in the summary view. You have options for the accounts used for your net worth, and for the income and spending calculations you can customize the accounts and categories.

- Create Reports Based on Reconciled Status. This is a small 'nice touch' but for many people, it will be very welcome. In the past, there was no way to find all of your uncleared or unreconciled transactions across all of your accounts. Now you can make a transaction report that does just that.

- Faster Direct Access. Get your transactions into Banktivity faster.

- New Account Types. We’ve added a bunch more account types and you can even change account types after an account has been created, within reason. For example, you can’t change an investment account to a checking account, but you can change an investment account to a 401k.

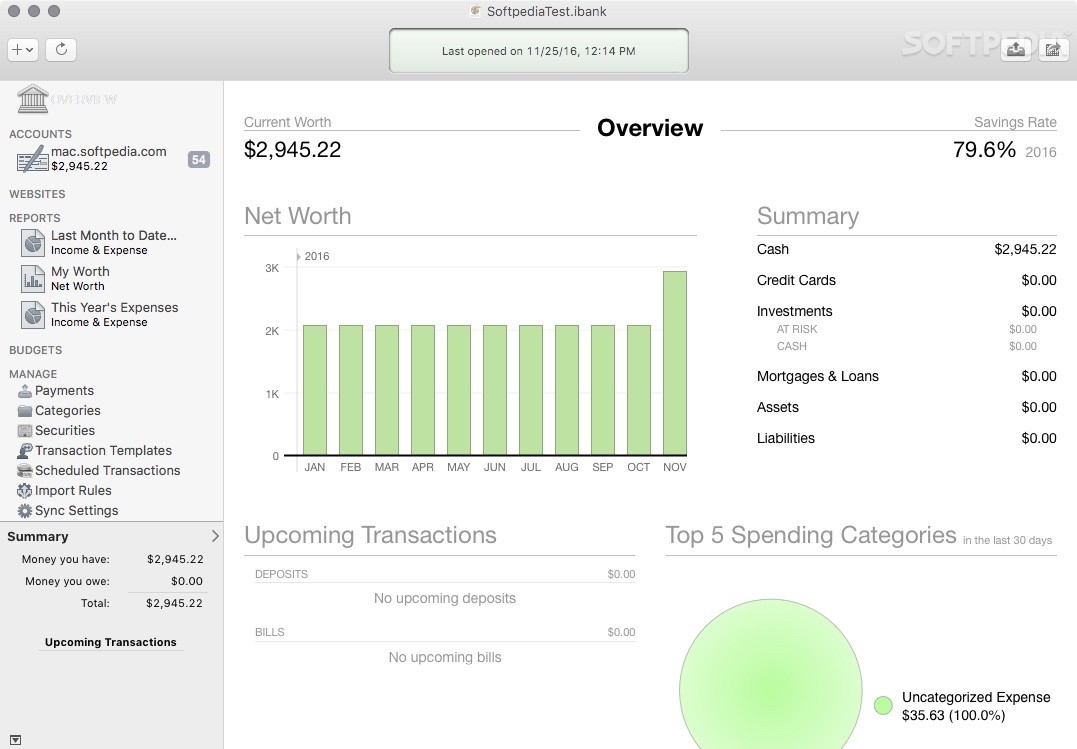

Screenshots:

- Title: Banktivity 7.5.3

- Developer: IGG Holdings, LLC

- Compatibility: macOS 10.12 or later, 64-bit processor

- Language: English

- Includes: K'ed by TNT

- Size: 26.4 MB

- View in Mac App Store

NitroFlare:

Managing money is hard, especially if you’re doing it on your own. Luckily, there is software out there that can help you plan out your expenses and keep track of your hard-earned cash.

One of the most popular ones out there is Quicken, a competitor and alternative to Mint. It’s a financial management program created by the people at Intuit.

But did you know there are other programs out there that can offer features the now 37-year-old Quicken’s software can’t?

In this post, we’ll be looking at the best Quicken alternatives out there, and even some free personal finance software replacement for Quicken.

Best Alternatives to Quicken

These are the most popular alternatives out there. Some of them have free features you can use but most of them cost money or require a monthly subscription. Most also offer a free 30 day trial.

InboxDollars: Paid over $57 Million to members to watch videos, take surveys, shop and more. Join InboxDollars Now and Get $5 Instantly!

Panda Research: Earn up to $50 per survey or offer completed. Join Panda Research Today!

Swagbucks: Get paid to watch videos, shop online, take surveys and more. Join Swagbucks Now & Get a $5 Instantly!

Smart App: Earn $15 a month just for installing their free app, plus loyalty bonus every three months! Join Smart App Now

Daily Goodie Box: Want free stuff? DGB will send you a box of free goodies (Free Shipping - No Credit Card). Get your box now!

Branded Surveys: This survey panel pays you $1 just for signing up today & they pay via PayPal within 48 hours! Join Branded Surveys

With that said, here are the best Quicken alternatives.

1. Banktivity

- Price: $69.99 (one time fee)

Available only for iOS, Banktivity is an app that allows you to condense your banking information into one place to make planning for the future easier.

2. Calendarbudget

- Price: $3.99/month

Calendarbudget is based around a simple idea: building a budget around a calendar. It’s available on the App Store and Google Play.

3. Chronicle

- Price: $19.99

Chronicle mainly functions as a reminder for bills, both present and future, and helps to keep track of your spending history. Chronicle has built-in support for multiple households, too! It is available for Mac, iPhone and iPad.

4. CountAbout

- Price: $9.99/year

If you have a Quicken account already, you can import all your information to CountAbout for free. They have a free 15-day trial, so you can get a feel for it before you buy.

5. Debitoor

- Price: starts at £4/mo

This one’s geared towards entrepreneurs, and has software to help build invoices, as well as keep track of expenses.

6. iFinance

- Price: $35.99 (for Mac) – $8.99 (for iOS)

This program is made specifically for Mac and iOS. It has a limited demo version you can download for free, so you can get a view of what iFinance has to offer.

7. Manager

- Price: $39/mo (Cloud version)

While a free option is available for this app, it has a cloud-based version that’s much more powerful and allows you to access your information from multiple devices.

8. Moneydance

- Price: $49.99 (one time fee)

Moneydance comes with the ability to handle multiple currencies, as well as a handy mobile app you can get on the App Store or Google Play.

9. Moneyspire

- Price: $29.99 (one-time fee)

Moneyspire sends you customizable reports on how your money is doing and how your finances change over time. The Pro version even allows you to create and track customer invoices.

10. MoneyWhiz

- Price: $14.99/year

Offers synced bookkeeping across multiple platforms, as well as a lot of automation tools to take care of any monthly payments that need to be kept track of.

11. Monzia

- Price: £48 annually

Based out of the UK, this is a resource for self-employed people who need help with their record-keeping. It requires a recurring membership, not a one-time purchase, so be aware of that.

12. Personal Capital

- Price: $ varies

Although Personal Capital is more centered towards investing than managing finances, it still is a great software like Quicken. After all, investing is part of money management.

It has two services, a wealth management app and ore importantly (for the purpose of this post) a free financial tracking app that does most of the things that Quicken does.

13. PocketSmith

- Price: $0.00 – $19.95/month

Pocketsmith has a clean, friendly UI and can not only keep track of your past and present finances but can project how you’ll be doing in the future.

14. QuickBooks

- Price: $15.00 – $50.00/month

Intuit’s latest paid program, this took over after they sold Quicken to a third party. They have a tiered payment system so you only pay for the features you need.

15. Receipts (Quicken alternatives for Mac)

- Price: $54.95

This program is only available for Macs, but it offers a wide range of features including support for scanners and automatic sorting of data.

16. Tiller

- Price: $6.58/month

Tiller makes it easy to keep all your “financial life” in a spreadsheet, where it’s updated automatically each day. You can start with one of their many templates to create a customized template for yourself. They also offer a 30 day free trial.

17. You Need A Budget

- Price: $11.99/month

YNAB has teaching tools to not only help you make a budget but learn how to handle money yourself in the future. It also features a 34-day free trial, which isn’t too shabby.

Free Software Like Quicken

Looking for free alternatives? These are the best ones out there that you can use. Some of them are app-only options and others work on a desktop. It’s up to you to decide what kind will fit best for yourself!

18. AceMoney Lite

Advertising itself as “the best free Quicken and Microsoft Money alternative,” AceMoney’s free Lite version offers a bunch of services (as long as you limit yourself to two accounts).

19. Bankin’

A free app available on the App Store and Google Play, Bankin’ allows you to categorize your spending and predict how much money you’ll have at the end of the month.

20. Cash Organizer

A simple, practical solution for finance management. It has a downloadable version for windows, as well as a web version that you don’t need to download!

21. Eqonomize

Eqonomize is a simple program designed to budget for small households, and is available for Windows and Linux.

22. EveryDollar

EveryDollar is a simple and easy to use software that lets you create a monthly budget quickly and easily. It’s a product from Dave Ramsey, one of the top money management experts.

There is a free and paid version. If you have a small business with more complicated finances, you might need the paid version, otherwise, the free version is great for personal money management.

For details and to learn whether it’s worth it or not, read our honest review of EveryDollar.

23. Expendy

Available only on Google Play, Expendy is a tool that can track your daily expenses by category as well as chart your income and expenditures.

24. Finice

Finice can help you chart your expenses, make a budget, and analyze how you’re doing financially.

25. FrontAccounting

FrontAccounting is free but encourages donations as it is run by a nonprofit. It’s a fairly unornamented, no-nonsense accounting program.

26. Gnuaccounting

A Java-based program that works across multiple platforms. It can integrate with your OpenOffice/LibreOffice accounts as well as your chipcard bank accounts and works on Windows or Linux.

27. GnuCash

Available on Windows, iOS, and even Linux, GnuCash is a good alternative for those looking for a way to keep track of their bank, stocks, and expenses without adding another subscription service to their list.

28. Grisbi

Grisbi was originally created in the year 2000 by French developers, and the English translation is a bit wonky, but it’s a free open-source software available on Github.

29. Hledger

This is a very simple, plain-text accounting software for people who want a no-frills and free budgeting app. Despite this, it supports multiple currencies and can produce balance sheets, income statements, and cash flow reports.

30. HomeBank

HomeBank is one of the most globally accessible software out there, having been translated into 56 different languages. It’s designed to be easy to use and offers support across multiple platforms.

31. KMyMoney

Created by the nonprofit KDE e.V., KMyMoney is a free open-source alternative to other financial software.

32. Kresus

Channel 7&4 In Traverse City

View your transactions through easy-to-read charts, establish a budget, and even set up email alerts for specific events or transactions so you can stay on top of things!

33. Ledger

If double-entry accounting is all you need, this lightweight program is for you. Uses the UNIX command line, so if that’s your OS of choice, here you go!

34. Mint

Intuit’s newest financial management software. It’s free to sign up, and its user interface looks more polished than Quicken does to the point where people online, especially on Reddit, refer to it as the money management tool that is “like Quicken but better“.

35. Money by Jumsoft

Available only for iOS, Money offers a number of features for free but also has in-app purchases to access more services.

36. Money Dashboard

This app is built for users in the United Kingdom and uses the Pound as its currency. It allows you to transfer money and work with more than 40 banks and providers.

37. Money Journal

This app is only available from the Google Play store and offers in-app purchases (so it’s not exactly free), but it does offer a nice amount of features with a simple interface that you can use without purchasing anything.

38. Money Manager EX

This is a free, open-source software that you don’t even have to install. It can be run from a USB drive, so you can take it (and your data) anywhere.

39. Money Plus Sunset

This is Microsoft’s accounting program, so it’s only available for Windows. If you’ve used previous versions of Money Plus, this one is a good replacement for those, as they are no longer supported.

Banktivity 7 4 2 3

40. Pecunia

Banktivity 7 4 2 3 As A Fraction

Originating from Germany, so you may have to use Google Translate on the site, Pecunia is an open-source program designed to be a secure way of keeping track of your banking data.

41. Skrooge

An open-source program based on KDE’s KMyMoney, Skrooge can run on more obscure operating systems like Linux, BSD or Solaris, in addition to the usual Mac OS and Windows.

Banktivity 7 4 200

Final Thoughts

There are a lot of programs similar to Quicken out there that can do what Quicken does, and a lot of them do it for free. It’s nice having a lot of options, but it’s important to take your time and find the right one for you, depending on your situation.

If you have a small household with only a couple of sources of income, it might be better to get a simple lightweight app that you can have with you and update as you go.

But if you run a business? It might be better to buy a program that has more features and can keep track of things like inventory and invoices.

Do you have a program other than Quicken that you use and didn’t see here? Tell us about it in the comments!